The Affordable Care Act (ACA), enacted to overhaul the US healthcare system, brought about significant changes, most notably the prohibition of denying coverage or charging higher premiums based on pre-existing health conditions. This pivotal shift, known as guaranteed issue and modified community rating, aimed to make health insurance accessible to everyone. Paired with tax credits for eligible individuals purchasing insurance through health insurance marketplaces, the ACA significantly broadened coverage, especially for those with pre-existing conditions.

However, these reforms introduced potential market imbalances. Insurers, facing new regulations, might have been incentivized to attract healthier individuals to minimize costs, rather than competing on plan quality and value. Furthermore, the initial years of the ACA brought pricing uncertainties as a broader and potentially sicker population entered the insurance pool, leading to concerns about premium volatility.

To counter these potential disruptions and foster a stable, competitive health insurance market, the ACA incorporated three crucial programs: risk adjustment, reinsurance, and risk corridors. This article delves into these programs, with a primary focus on the Affordable Care Act Risk Adjustment Program Extended, exploring its mechanics, objectives, and long-term implications for the healthcare landscape.

Understanding Adverse Selection and Risk Selection in Health Insurance

Before diving into the specifics of the risk adjustment program, it’s essential to understand two key concepts that underpin its necessity: adverse selection and risk selection.

Adverse selection arises from the information asymmetry between insurers and consumers. Individuals with greater healthcare needs are more likely to seek insurance coverage. If this tendency is unchecked, the insurance pool becomes skewed towards higher-risk individuals, leading to increased average premiums. This, in turn, can deter healthier individuals from purchasing insurance, further escalating premiums and potentially destabilizing the entire market. The ACA addresses this by mandates requiring most individuals to have coverage, limiting enrollment periods, and offering subsidies to make insurance more affordable.

Risk selection, on the other hand, is the strategic behavior of insurance companies. Even with guaranteed issue and community rating, insurers might still try to avoid enrolling individuals with higher healthcare costs. This can manifest in various forms, such as designing plans with benefit structures or drug formularies that are less attractive to those with chronic conditions. Risk selection distorts market efficiency, shifting competition from providing better value to attracting healthier enrollees, ultimately undermining the goals of healthcare reform.

The ACA’s risk adjustment, reinsurance, and risk corridors programs were specifically designed to counteract both adverse selection and risk selection, ensuring market stability and reasonable premiums, particularly in the crucial early years of the ACA’s implementation. These programs, while sharing the overarching goal of market stabilization, differ in their mechanisms, participating plans, oversight responsibilities, funding sources, and durations.

| Table 1: Key Features of ACA Risk and Market Stabilization Programs |

|---|

| Program |

| Function |

| Purpose |

| Participation |

| Mechanism |

| Timeline |

Delving Deeper: The Affordable Care Act Risk Adjustment Program

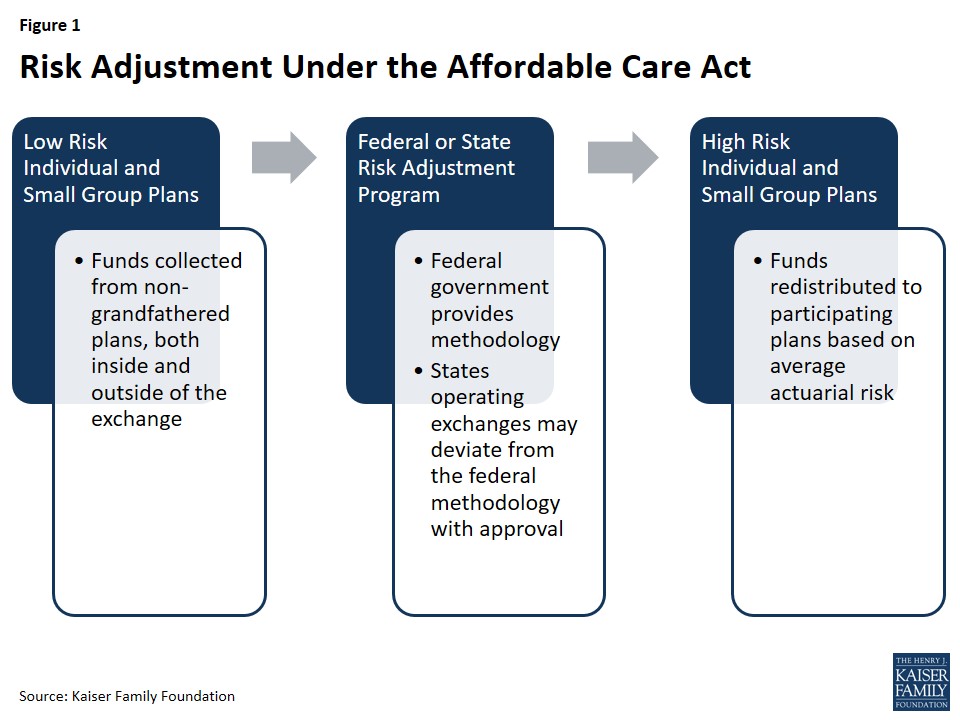

The ACA’s risk adjustment program stands as a cornerstone of market stabilization, designed to operate permanently and counteract the incentives for risk selection that persist even with guaranteed issue and community rating. Its primary mechanism is to redistribute funds from health insurance plans with a predominantly healthy enrollee population to those plans that enroll a higher proportion of individuals with significant health needs. This financial transfer is crucial in leveling the playing field for insurers, encouraging them to compete on the basis of service quality, network breadth, and efficient care delivery, rather than on attracting only the healthiest customers.

By mitigating risk selection, the risk adjustment program also contributes to broader premium stability across the health insurance marketplaces. If insurers operating outside the exchanges were to aggressively pursue healthy applicants while subtly discouraging sicker individuals, it could lead to adverse selection within the exchanges, driving up premiums and increasing the federal government’s subsidy burden. Risk adjustment acts as a counterbalance, promoting a more balanced risk pool across all market segments.

Figure 1: Visual representation of the Risk Adjustment mechanism within the Affordable Care Act, showing fund redistribution from low-risk to high-risk plans to stabilize the insurance market.

Program Participation in Risk Adjustment

The risk adjustment program’s reach extends to all non-grandfathered health insurance plans in the individual and small group markets, regardless of whether they are sold within or outside of the health insurance exchanges. Grandfathered plans, those existing when the ACA was enacted in March 2010, are subject to fewer ACA requirements and are therefore excluded from risk adjustment. However, plans lose their grandfathered status if they undergo significant changes that reduce benefits or increase cost-sharing. Plans renewed before January 1, 2014, and thus not yet fully under ACA regulations, are also not part of the risk adjustment system. Multi-state plans and Consumer Operated and Oriented Plans (CO-OPs), however, are included. Unless a state opts to merge its individual and small group markets, separate risk adjustment systems operate in each market segment.

Government Oversight: Federal and State Roles

States operating their own health insurance exchanges have the choice to administer their own risk adjustment programs or defer to the federal government. States that do not establish their own exchanges and instead utilize the federally-run Health Insurance Marketplace must rely on the federal risk adjustment model. In states where the federal government (HHS) operates the program, insurers are charged a fee to cover administrative costs.

HHS has developed a federally-certified risk adjustment methodology that states can adopt or adapt. States wishing to implement an alternative model must seek federal approval and provide annual reports to HHS. States choosing to run their own programs must publish benefit and payment parameters by March 1st of the year preceding the benefit year to maintain the option to deviate from the federal methodology. Once approved, a state’s alternative methodology becomes federally-certified and potentially usable by other states. Massachusetts was the only state to operate its own risk adjustment program initially, but discontinued it in 2017, leading to HHS operating risk adjustment programs in all states from 2017 onwards.

Calculating Payments and Charges: Risk Scores and Transfers

At the heart of the risk adjustment program lies a sophisticated methodology for assessing and comparing the average financial risk of different insurance plans’ enrollees. The HHS methodology utilizes enrollee demographics and claims data for specific medical diagnoses to estimate financial risk. Plans within the same geographic area and market segment are then compared based on the average risk of their enrollees to determine payment obligations or entitlements.

The cornerstone of this calculation is the individual risk score. Each enrollee is assigned a risk score based on their age, sex, and diagnoses. Diagnoses are categorized into Hierarchical Condition Categories (HCCs), each assigned a numeric value representing the predicted healthcare expenditure for an enrollee with that condition. If an individual has multiple unrelated diagnoses, the HCC values for each are incorporated into their individual risk score. Interaction factors are also applied for adults with specific combinations of illnesses, and an induced utilization factor adjusts for enrollees receiving cost-sharing subsidies.

After calculating individual risk scores for all enrollees in a plan, these are averaged to arrive at the plan’s average risk score. This average score represents the plan’s predicted expenses. The HHS methodology further adjusts for factors such as actuarial value (plan cost-sharing levels), allowable rating variation, and geographic cost variations. Ultimately, plans with a lower average risk score compared to the state average premium make payments into the system, while plans with a higher average risk score receive payments.

These financial transfers are calculated for each geographic rating area, and insurers operating in multiple rating areas within a state receive a consolidated invoice reflecting the net payments or charges. Importantly, the total payments and charges within a given state are designed to net to zero, ensuring the program is budget-neutral.

Ongoing Refinements and Data Enhancements

Recognizing the dynamic nature of the healthcare market and the need for continuous improvement, CMS has actively reviewed and refined the risk adjustment methodology since its inception. A public conference in March 2016 and a subsequent white paper explored potential enhancements based on the initial years of program experience.

Key areas of focus for refinement include incorporating partial year enrollees and prescription drug utilization into the risk adjustment model. Starting in 2017, the model began accounting for partial-year enrollment, and prescription drug use was integrated in 2018. Furthermore, preventive services are now incorporated into plan liability simulations, and different trend factors are applied to traditional drugs, specialty drugs, and medical/surgical expenditures to better reflect the rising costs of prescription medications. The risk adjustment model is also regularly recalibrated using the most recent claims data, ensuring its accuracy and relevance.

In response to feedback from insurers after the initial 2014 benefit year, CMS began providing early estimates of plan-specific risk adjustment calculations to give insurers more timely information for premium setting. CMS has also signaled ongoing exploration of further modifications to the permanent risk adjustment program to better account for high-cost enrollees, particularly as the temporary reinsurance program concluded in 2016.

Data Collection, Privacy, and Program Integrity

Protecting consumer privacy is paramount in the risk adjustment program. Under the federal model, insurers are required to provide HHS with de-identified data, including enrollees’ individual risk scores, to maintain confidentiality. State-run programs must also adhere to stringent privacy regulations, collecting only data necessary for program operation and prohibiting the collection of personally identifiable information. Insurers may require healthcare providers to submit necessary data for risk adjustment calculations.

To participate in risk adjustment, insurers must establish a secure dedicated data environment (EDGE server) and provide data access to HHS within specified timeframes. CMS provides detailed guidance for EDGE data submissions. To ensure data accuracy, HHS recommends independent data audits by insurers, followed by a second audit by HHS. Initially, for the 2014 and 2015 benefit years, no payment adjustments were made as HHS optimized the data validation process. However, starting in 2016, failure to establish an EDGE server, submit data, or address audit findings can result in adjustments to an insurer’s average actuarial risk, payments, or charges. Default risk adjustment charges are assessed for issuers failing to provide timely EDGE server data access.

Payments and Program Outcomes: 2014 and 2015 Benefit Years

The risk adjustment program’s financial impact is substantial. For the 2014 benefit year, HHS announced transfers of $4.6 billion among insurers, with 758 participating issuers. Independent analyses confirmed that the program functioned as intended, with the relative health of enrollees being the primary determinant of whether an insurer received a risk adjustment payment. CMS data indicated this as a positive sign of the risk adjustment formula effectively transferring funds from plans with healthier enrollees to those with sicker populations.

For the 2015 benefit year, risk adjustment transfers averaged approximately 10% of premiums in the individual market and 6% in the small group market, consistent with 2014 figures. 821 issuers participated in the program. Individual reports detailing each issuer’s risk adjustment payment or charge were made available by HHS. It’s important to note that risk adjustment payments for the 2015 benefit year were subject to sequestration at a rate of 7% due to government-wide spending cuts.

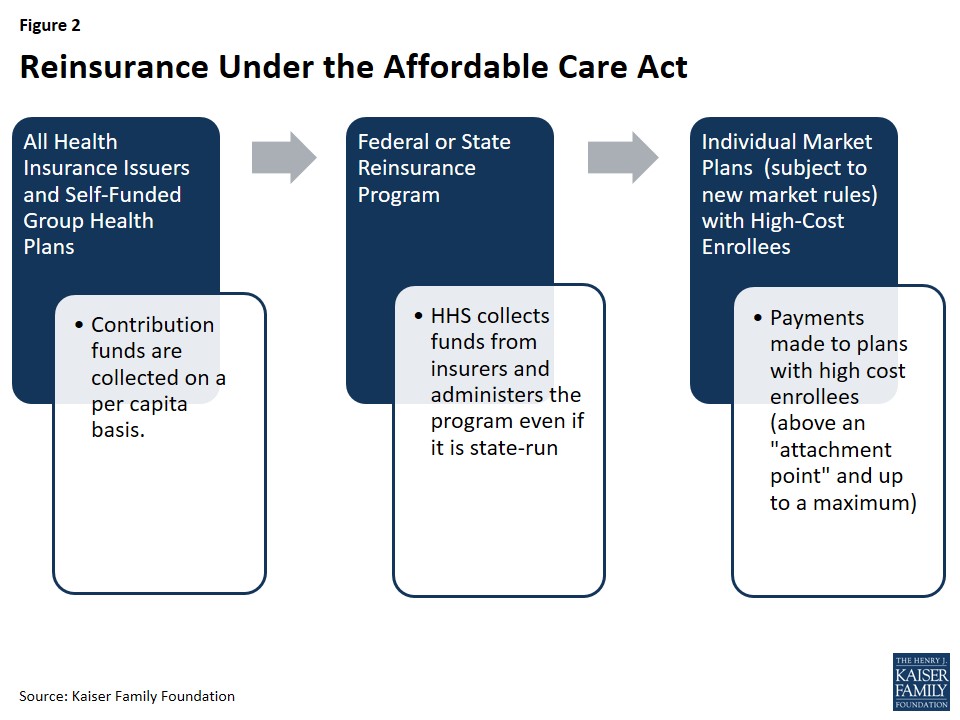

Reinsurance: A Temporary Bridge to Stability

The ACA’s temporary reinsurance program, active from 2014 through 2016, served as another critical mechanism to stabilize individual market premiums during the initial years of market reforms, particularly guaranteed issue. Reinsurance aimed to alleviate insurers’ concerns about higher-risk individuals enrolling early on, thereby reducing the incentive for insurers to set excessively high premiums.

Reinsurance differs from risk adjustment in its temporality and focus. While risk adjustment is a permanent program designed to mitigate risk selection, reinsurance was a temporary measure to address initial market uncertainties and high-cost enrollees. Reinsurance payments are exclusively for individual market plans adhering to new market rules, whereas risk adjustment applies to both individual and small group plans. Furthermore, reinsurance payments are based on actual healthcare costs, while risk adjustment payments are based on predicted costs. Reinsurance thus provides a safety net even for unexpectedly high costs incurred by low-risk individuals due to unforeseen events. Notably, plans could receive both reinsurance and risk adjustment payments for the same high-cost enrollees.

Figure 2: Diagram illustrating the Reinsurance program under the ACA, showing funds flowing into the individual market to subsidize costs for high-risk enrollees and stabilize premiums.

While risk adjustment is budget-neutral within market segments, reinsurance represents a net inflow of funds into the individual market, effectively subsidizing premiums for a limited period. Funds for reinsurance payments and program administration were collected from all health insurance issuers and third-party administrators across individual and group markets. HHS distributed reinsurance payments based on need, not proportionally to state contributions.

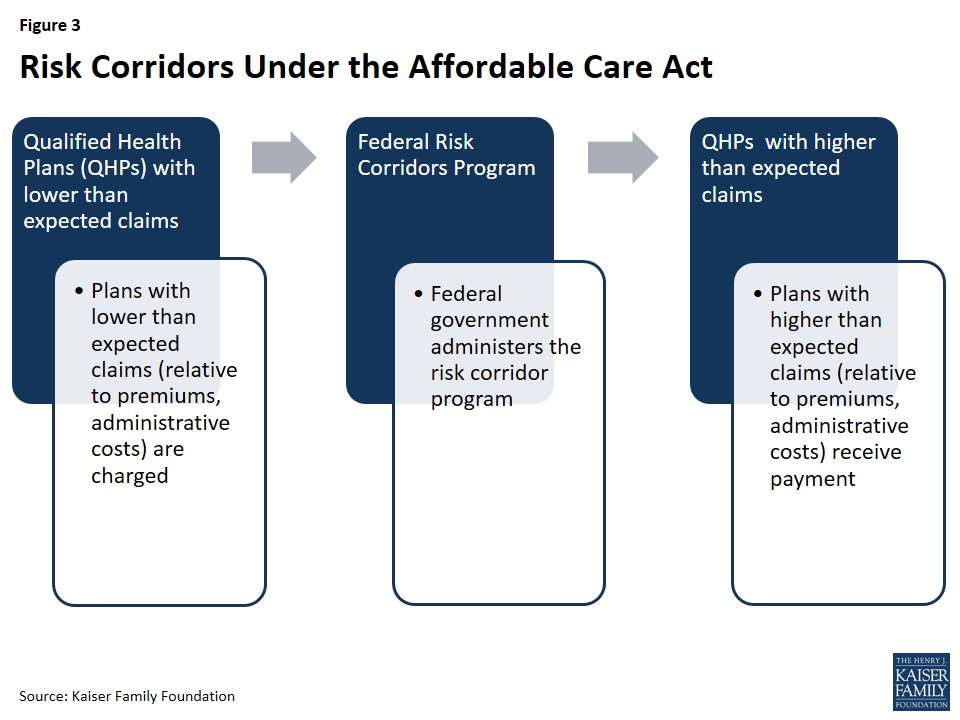

Risk Corridors: Sharing the Early Market Risk

The third temporary stabilization program under the ACA was risk corridors, also in effect from 2014 to 2016. Risk corridors were designed to encourage insurer participation in the exchanges and promote accurate premium setting during the initial years of operation. By sharing the risk of unexpectedly high or low claims, the program aimed to mitigate insurer uncertainty and prevent overly cautious (and high) premium setting in response to the unknown risk pool of the newly formed exchanges.

Figure 3: A visual representation of the Risk Corridors program within the ACA framework, illustrating the sharing of gains and losses between the government and participating insurers to stabilize premiums during the initial market years.

Risk corridors operated by setting a target for participating exchange insurers to spend 80% of premium revenue on healthcare and quality improvement, aligning with the ACA’s Medical Loss Ratio (MLR) provision. Insurers with costs significantly below this target (less than 97% of expected costs) were required to make payments into the risk corridors program. Conversely, plans with costs exceeding the target (more than 103% of expected costs) were eligible for payments from the program. This two-way risk sharing mechanism was intended to cushion insurers from extreme financial outcomes during the early years of the exchanges.

Conclusion: A Multi-faceted Approach to Market Stability

The Affordable Care Act’s risk adjustment, reinsurance, and risk corridors programs represented a comprehensive and complementary strategy to stabilize the newly reformed health insurance market. While reinsurance and risk corridors were temporary measures designed to address specific challenges during the initial years of ACA implementation, the risk adjustment program was intended as a permanent mechanism to ensure long-term market stability and fair competition.

These programs worked in concert to mitigate adverse selection and risk selection, encourage insurer participation, and promote reasonable premiums. Risk adjustment addresses the ongoing issue of risk selection, while reinsurance provided crucial temporary premium subsidies. Risk corridors aimed to reduce initial market uncertainty, although its effectiveness was limited by subsequent congressional actions that made the program revenue-neutral, leading to significant underfunding.

As the temporary reinsurance program concluded in 2016, and risk corridors also ended, the Affordable Care Act risk adjustment program extended its role as the primary permanent mechanism for market stabilization. The expiration of reinsurance is considered a contributing factor to anticipated premium increases in subsequent years, highlighting the importance of the ongoing risk adjustment program in maintaining a stable and accessible health insurance market under the ACA.